Irs auto depreciation calculator

510 Business Use of Car. The calculator also estimates the first year and the total vehicle depreciation.

Depreciation Calculator Depreciation Of An Asset Car Property

Discover Helpful Information And Resources On Taxes From AARP.

. D i C R i. C is the original purchase price or basis of an asset. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

All you need to do is. Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade.

If you use this method you need to figure depreciation for the vehicle. IRS Issues New 2022 Rules for Passenger Car Depreciation The IRS has provided updated tables containing. For cars that are 5 years and beyond the rate is decided.

Example Calculation Using the Section 179 Calculator. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used. Absent this safe harbor method.

You can claim business use of an automobile on. Depreciation deduction limits for passenger. Schedule C Form 1040 Profit or Loss From.

In the example above your depreciation on an auto would be limited to the business-use percentage of 90 times the maximum 2021 first-year maximum of. Ushered in with the Tax Cuts and Jobs Act bonus depreciation makes it possible to claim 100 of the cost of any. Claim your deduction for depreciation and amortization.

Use Form 4562 to. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. NW IR-6526 Washington DC.

Provide information on the. Likewise if the age of car is 3-4 years the rate of depreciation is 40. Accelerating depreciation with bonus depreciation.

Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Select the currency from the drop-down list optional Enter the. We will even custom tailor the results based upon just a few.

The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle. And for 4-5 year old car the depreciation rate is 50. Where Di is the depreciation in year i.

You probably know that the value of a vehicle drops. The IRS addressed a quirky interaction of bonus depreciation under IRC 168k and the luxury auto rules under IRC 280F in Revenue Procedure 2019-13. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

Car Depreciation Calculator. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the 100.

Make the election under section 179 to expense certain property. We base our estimate on the first 3 year. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

It is fairly simple to use. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. The MACRS Depreciation Calculator uses the following basic formula.

A car 463 Travel Gift and Car Expenses Residential rental property. A P 1 - R100.

Macrs Depreciation Calculator Based On Irs Publication 946

Sample Catering Receipt Template Receipt Template Business Template Templates

Macrs Depreciation Calculator Straight Line Double Declining

Pin On Projects To Try

Macrs Depreciation Calculator

Macrs Depreciation Calculator Irs Publication 946

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

Automobile And Taxi Depreciation Calculation Depreciation Guru

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Macrs Depreciation Calculator Irs Publication 946

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Business Inspiration Quotes

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Free Macrs Depreciation Calculator For Excel

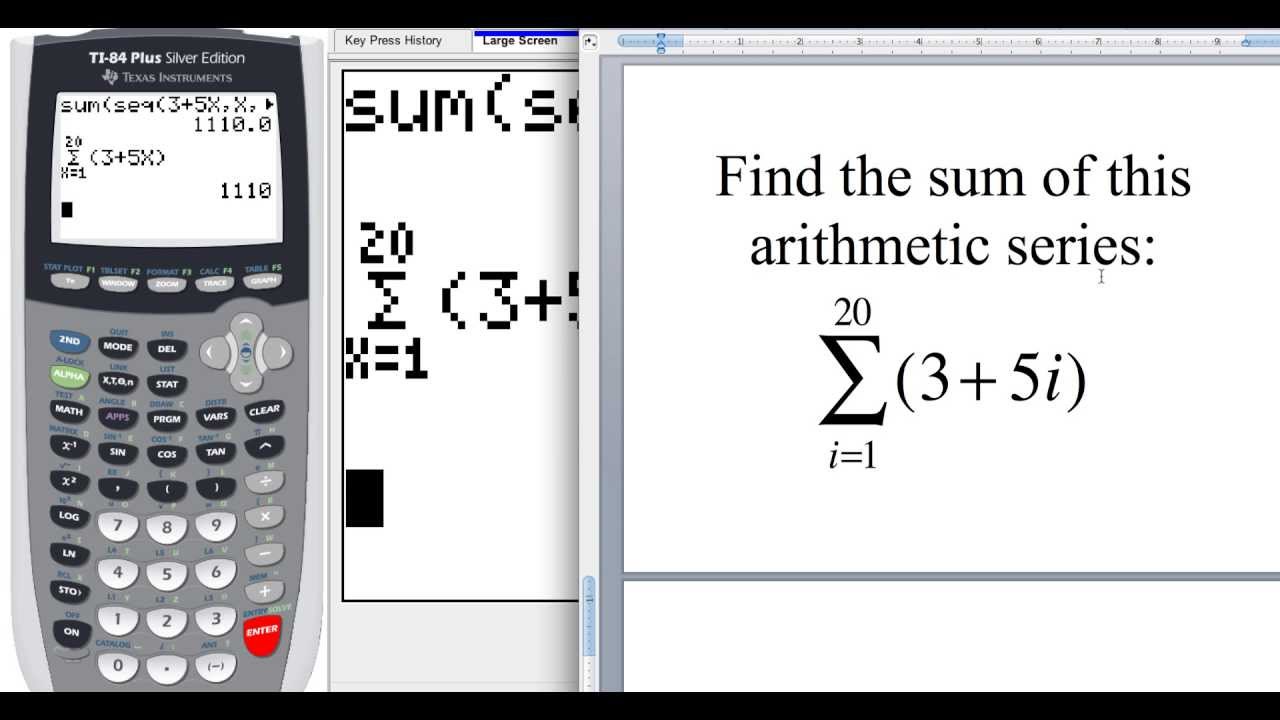

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

Sz1znxdfmlybgm

Automobile And Taxi Depreciation Calculation Depreciation Guru

Macrs Depreciation Calculator With Formula Nerd Counter